Discover Neighboring Protection: Medicare Supplement Plans Near Me

Discover Neighboring Protection: Medicare Supplement Plans Near Me

Blog Article

Selecting the Right Medicare Supplement for Your Insurance Plan

When it comes to guaranteeing detailed healthcare protection, selecting the suitable Medicare supplement plan is a crucial choice that requires mindful factor to consider. By taking the time to research and analyze these elements, you can with confidence protect a Medicare supplement plan that finest matches your insurance policy and gives the insurance coverage you call for.

Understanding Medicare Supplement Plans

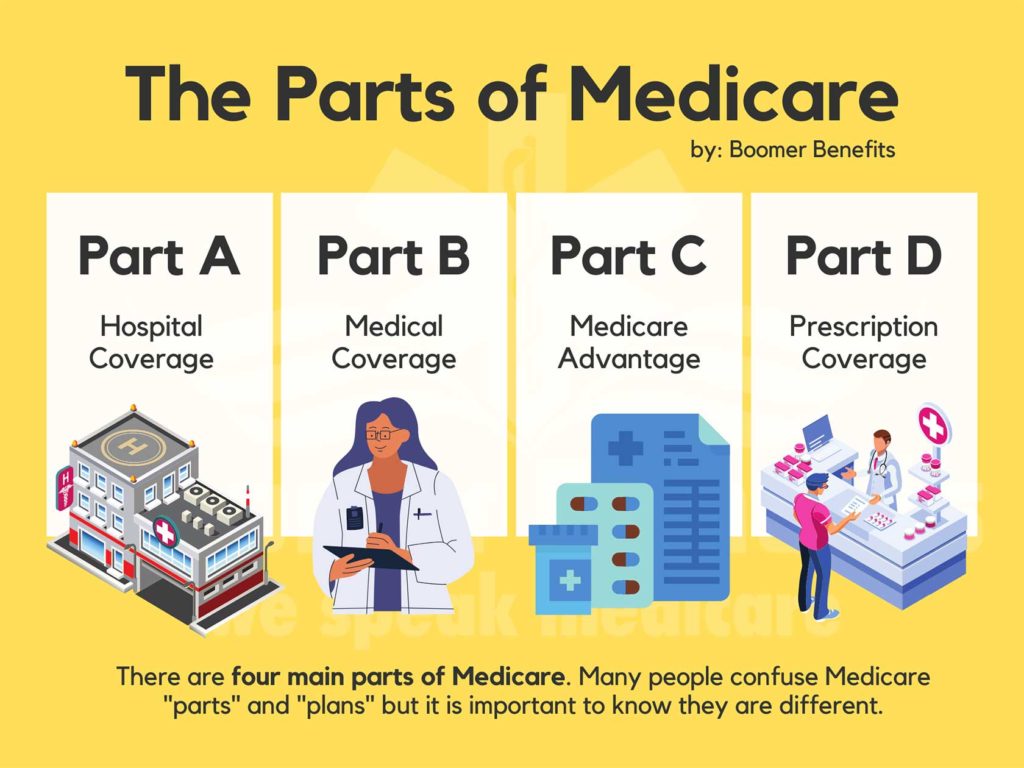

When browsing the intricacies of Medicare, individuals typically discover themselves taking into consideration numerous Medicare Supplement prepares to complement their existing insurance coverage. Medicare Supplement intends, likewise referred to as Medigap policies, are supplied by personal insurance provider to help cover the gaps in Initial Medicare, including copayments, coinsurance, and deductibles. These strategies are standardized and identified with letters, such as Plan A, Strategy B, as much as Plan N, each supplying different degrees of coverage.

It is important for individuals to understand that Medicare Supplement plans work alongside Original Medicare and can not be utilized as standalone coverage. These plans generally do not include prescription medication coverage; individuals may need to enroll in a different Medicare Component D strategy for prescription drugs.

When reviewing Medicare Supplement prepares, it is vital to contrast the benefits offered by each plan, in addition to the associated costs. Premiums, protection options, and supplier networks can vary in between insurer, so people need to carefully assess and contrast their alternatives to choose the plan that best fulfills their medical care demands and budget.

Assessing Your Medical Care Demands

Contrasting Plan Options

Upon evaluating your healthcare needs, the following step is to contrast the numerous Medicare Supplement plan choices offered to figure out the most suitable protection for your medical expenses (Medicare Supplement plans near me). When comparing plan options, it is vital to consider aspects such as protection advantages, prices, and company networks

To start with, analyze the insurance coverage advantages provided by each strategy. Different Medicare Supplement strategies supply differing levels of coverage for solutions like hospital remains, experienced nursing care, and doctor gos to. Review which advantages are essential to you based upon your healthcare demands.

Second of all, contrast the prices connected with each strategy. This includes month-to-month premiums, deductibles, copayments, and coinsurance. Medicare Supplement plans near me. Comprehending the complete expense of each plan will certainly aid you make an informed decision based on your budget plan and economic situation

Last but not least, take into consideration the service provider why not look here networks connected with the plans. Some Medicare Supplement strategies may restrict you to a network of doctor, while others allow you to see any kind of medical professional that approves Medicare patients. Make sure that your favored health care providers are in-network to avoid unanticipated out-of-pocket expenses.

Reviewing Prices and Insurance Coverage

To make a notified decision on choosing the most appropriate Medicare Supplement strategy, it is important to completely assess both the expenses linked with each strategy and the protection advantages they offer. On the various other hand, greater premium plans might offer more thorough coverage with lower out-of-pocket expenditures.

Along with costs, carefully assess the insurance coverage benefits provided by each Medicare Supplement plan - Medicare Supplement plans near me. Various plans offer varying levels of coverage for solutions such as medical facility stays, skilled nursing treatment, and outpatient care. Make sure the plan you select lines up with your health care needs and budget plan. It's also necessary to inspect if the plan includes added advantages like vision, oral, or prescription medicine coverage. By evaluating both prices and insurance coverage, you can select a Medicare Supplement plan that meets your monetary and medical care requirements effectively.

Joining in a Medicare Supplement Plan

To be eligible for a Medicare Supplement strategy, people have to be registered in great site Medicare Component A and more helpful hints Component B. Normally, the best time to enroll in a Medicare Supplement plan is throughout the open registration period, which begins when an individual turns 65 or older and is enrolled in Medicare Part B. Throughout this duration, insurance policy firms are normally not allowed to reject protection or cost higher premiums based on pre-existing conditions. It is crucial to be mindful of these registration periods and eligibility standards to make a notified decision when choosing a Medicare Supplement strategy that finest fits individual medical care requirements and economic situations.

Final Thought

To conclude, selecting the proper Medicare Supplement strategy needs a thorough understanding of your healthcare needs, comparing different plan alternatives, and assessing prices and insurance coverage. It is very important to enlist in a strategy that straightens with your specific demands to make certain detailed medical insurance coverage. By carefully evaluating your options and picking the ideal strategy, you can secure the essential assistance for your medical expenditures and medical care requirements.

Report this page